- Personal Loan

- 2025 Dec 27 Dec 2025

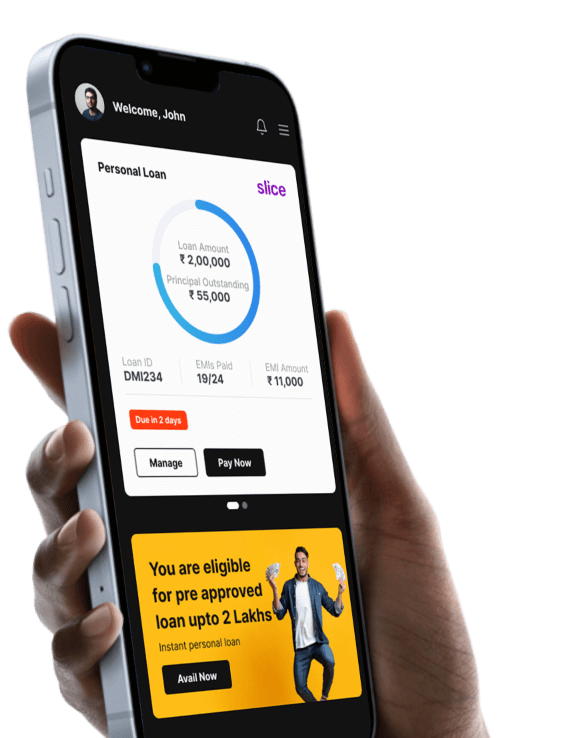

A simple EMI calculator to plan your payments.

₹ 10,000 ₹ 4,00,000

1 Year 6 Years

10% 25%

Avail DMI personal loan to meet any financial requirement, be it for funding your wedding, travel, hospital bills, or any unplanned expenses.

Quick and easy support for your loan disbursal and repayment.

Yes, applying for a loan online has many advantages:

No, there are no tax benefits associated with a Personal Loan.

Personal Loan tenure can range from 3 months to 48 months.

Yes, there are pre-closure charges associated with loans. They generally range from 2% to 4%.

Missing an EMI payment can lead to late fees and negatively impact your credit score. Continuous defaults could result in legal action.

No, a Personal Loan is available to both salaried and self-employed individuals.