Download DMI Finance App! Click here

View your next EMI date and other loan details by following the steps below: Log in to Customer Portal > Dashboard > Click “view” > Select “Payment Summary”

A Housing Loan from DMI is for the purchase of a new home. It can be either from a builder or a previous owner.

A Loan Against Property (LAP) from DMI is a loan against a home that you already own and are not in the process of purchasing. DMI helps you unlock some of the money tied up in your home by taking the property as collateral.

A Personal Loan from DMI is an unsecured loan that provides you with money to spend on whatever you need, repaid in EMIs over the life of the loan. For instance, a Personal Loan for ₹1 Lakh repaid over 24 months. You get the money today to spend on, say, a wedding, and then you pay us back in 24 EMIs.

A Consumption Loan from DMI is for when you want to buy something today but need a loan to complete the purchase. DMI pays the loan amount to the merchant from whom you are buying, and you repay DMI in monthly EMIs. For instance, if you want to buy a smartphone for ₹40,000 but need to borrow ₹30,000 for 6 months to make the purchase, DMI would pay the seller ₹30,000, you would pay the seller ₹10,000, and then you would repay DMI over 6 months. Consumption Loans range from 3 to 12 months.

GST is a destination-based tax on the consumption of goods and services. It is proposed to be levied at all stages on taxable goods and services, with credit of taxes paid available as a setoff to customers. In a nutshell, only value addition will be taxed, and the burden of tax is borne by the final consumer.

A credit score is a three-digit number that ranges between 300 and 900. It is calculated based on your credit behaviour and history, such as timely EMI payments and maintaining a sufficient account balance before the due date.

A healthy credit score can be maintained/improved by:

• Making timely EMI payments and credit card payments.

• You should not have any pending loan/ credit card payments.

It is generally advisable to have a Credit/Bureau score of 750 or above to qualify for a personal loan.

• A score of 750 or above is considered to be good to qualify for a personal loan.

• A score of 550-750 is considered to be a fair credit score and may get charged lightly higher interest rate on loans.

• A score between 300-550 may not get approved for credit at all.

• A score of -1(Minus One) indicates no credit history or activity in last few years.

• A score of 0 (Zero) indicates that your credit history is available only up to a period of 6 months.

A score of -1(Minus One) indicates no credit history or activity in last few years.

A score of 0 (Zero) indicates that your credit history is available only up to a period of 6 months.

After closure of the loan, the credit records will get updated by the 25th of next month. In case of any discrepancy, please write to us at customercare@dmifinance.in.

You can contact us through our various service channels.

Write to us at customercare@dmifinance.in mentioning your Loan account number or registered mobile number.

Login to our customer portal to access loan details and raise a request.

When you avail a loan from DMI sourcing partners/loan aggregators, your credit bureau will reflect a loan from DMI Finance. However, if you have not availed any loan, you can write to us at customercare@dmifinance.in with a description of your issue and with your CIBIL/Credit report attached.

It takes approximately 45 to 60 days for the records to update in the credit bureau database.

Please note, if your report is not updated within 60 days, kindly write to us at customercare@dmifinance.in. mentioning the issue along with the copy of your latest credit report and a screenshot of the report where it shows as active.

For instant information, log on to our customer portal using https://portal.dmifinance.in or alternatively you can use Hello DMI.

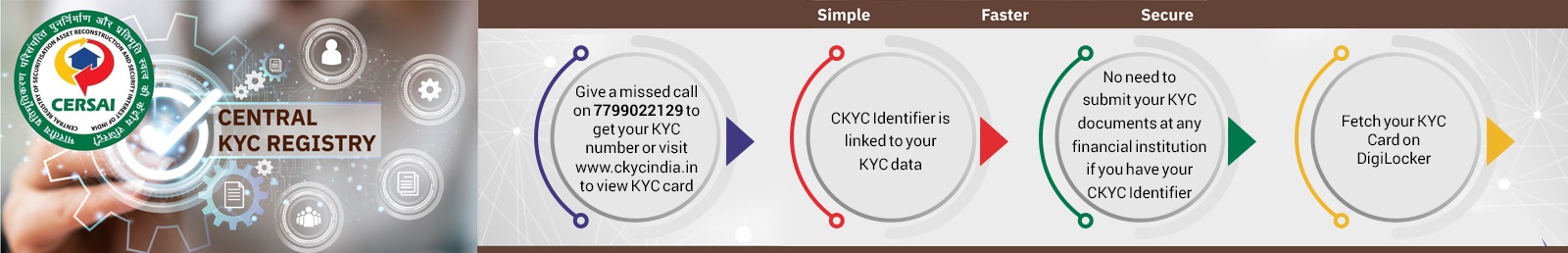

Central Know Your Customer (CKYC) is a Government of India initiative that simplifies how you manage your KYC information. Visit https://www.ckycindia.in/ to know more.