The implementation of Know Your Customer (KYC) norms have improved the overall financial safety in our society as it prevents bank accounts from being used by criminals as avenues for money-laundering activities. It also helps banks to understand their customers and their financial dealings, which enables them to provide better services and manage risks well.

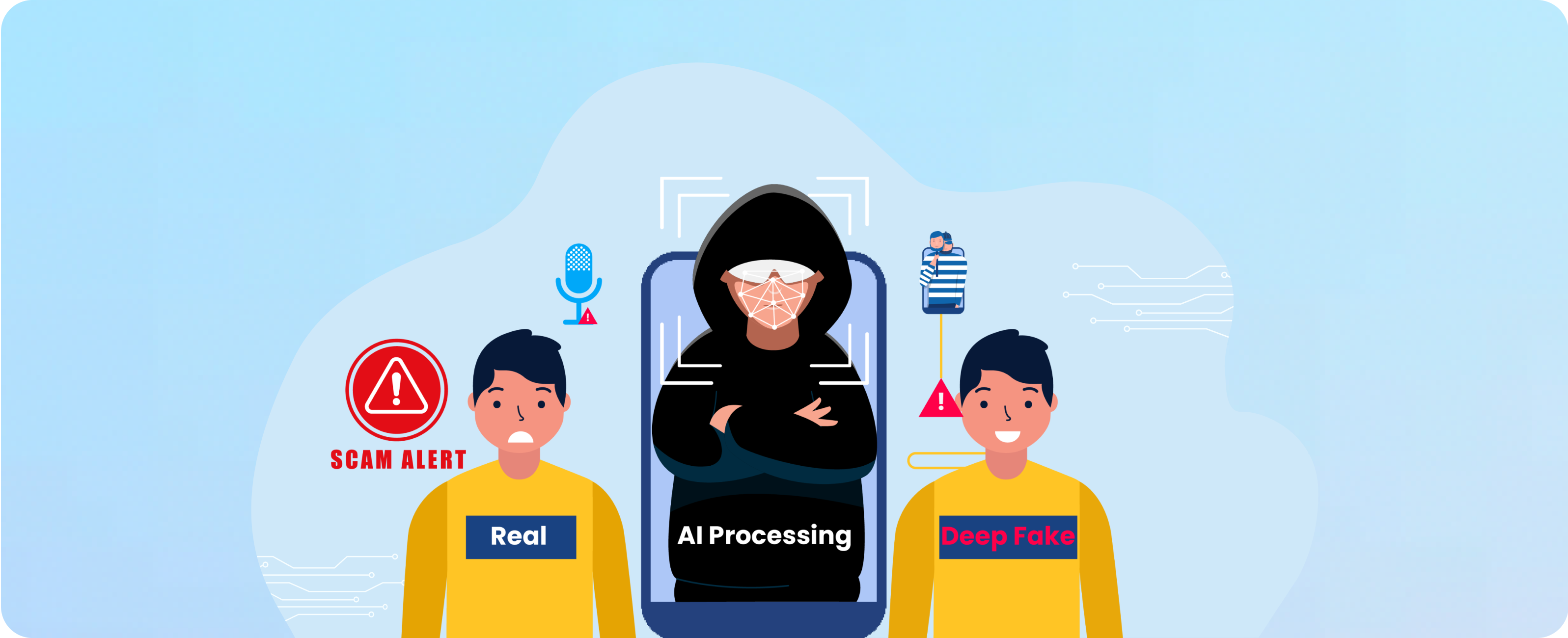

However, scamsters are now trying to use KYC verifications to get your passwords and personal information, which they can then use to defraud you.

How does it work?

- You may receive a message telling you that your KYC needs verification and if you fail to complete this process, your digital wallet will be blocked.

- To gain your trust, they may say that you should not share your information with anyone, including them. But instead, they will request you to download an app, like TeamViewer or QuickSupport, and fill in your details there.

- These apps do not belong to your digital wallet provider; they are external apps that offer the fraudsters remote access to view your screen.

- You may then be asked to transfer a small amount, of say Rs. 2 or Rs. 10.

- When you do this, the Password or PIN that you type will be visible to the fraudster, who can then use the same to transfer large amounts out of your account!

How can you avoid being scammed?

- Avoid downloading an app. First, check if your bank or payments platform has an app and what the app is called.

- Be wary of apps requiring you to fill in your Bank account, Aadhaar, or Mobile details.

- Be particularly careful of SMS or WhatsApp prompts for KYC, Aadhaar, PIN, or OTP details.

The next time you get a call asking you to undertake KYC verification, you know what to do. Just hang up!